The COVID-19 pandemic has caused a major shift in the automotive industry. Vehicle sales and service requests took a drop the last three months, while parts sales have soared above the seasonal lifts.

We’ll be taking a look at just how much the automotive industry took a hit in their go-to revenue streams, and how record online part and accessory sales have been the only upside for some dealers during this whole pandemic.

Car Sales

Dealerships saw the full impact of the coronavirus shutdowns in the second quarter. Between March 2nd and May 3rd, the automotive industry saw a drop of 1.5 million in new and used car sales. That equals a loss of $41 billion in revenue and $2.6 billion in profit for dealers.

For those that were in the industry during the last recession, it might feel like Groundhog Day. Edmunds estimates that sales fell 34.3% through the quarter. Big players like GM saw a 34% decline and FCA got hit with a 39% decrease in US sales.

The Effects of COVID-19 on Car Sales

DECREASE IN VEHICLE SALES

1.5 MILLION UNITS

DECREASE IN VEHICLE REVENUE

$41

BILLION

DECREASE IN DEALER PROFIT

$2.6

BILLION

Collision Repair and Maintenance

As the pandemic spread, dealerships realized just how real things were about to get. Typically recession-proof, the service departments at the dealerships took a hard hit when people began fearing the virus.

Collisions dropped and consumers were prioritizing essential repair work over regular maintenance. Service requests fell 56% in March, 35% in April, and 27% in May compared to the previous year. Social distancing guidelines might have put a wrench in things for brick and mortar auto parts and tire shops, but this is great news for online part stores!

Parts and Accessories Sales

The automotive aftermarket is historically recession-resistant. Customers might not be purchasing cars, but they’re doing what they can to keep the cars they have running. Turns out that garages and driveways are great places for DIYers (or those willing to watch a YouTube video and learn) to social distance.

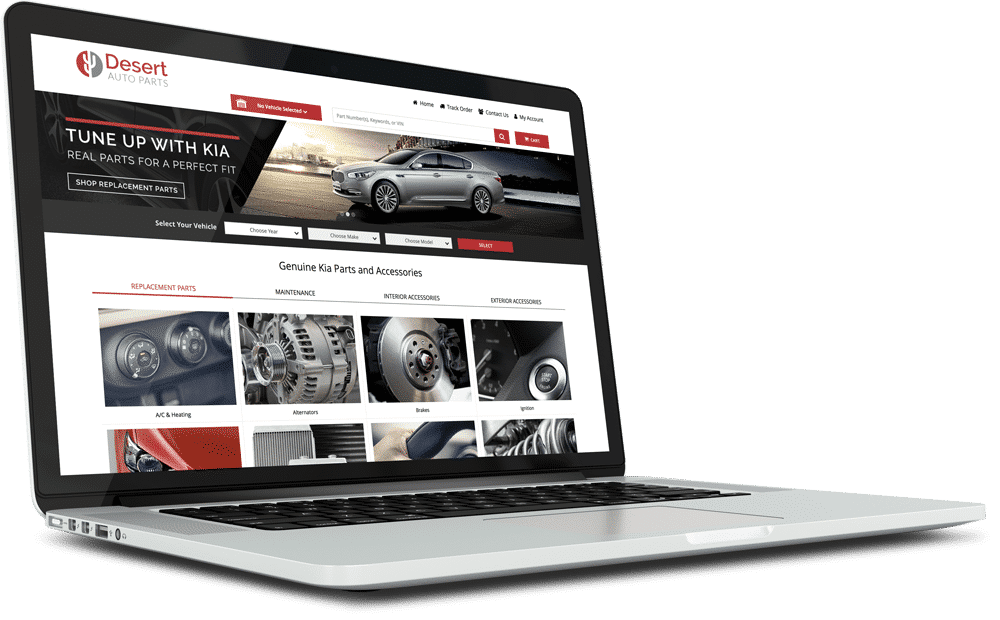

Online dealers saw a drop in part and accessory sales that seemed to fall below standard trends as states created mandatory lockdowns and businesses shut their doors. But, the minute stimulus checks kicked in, sales picked up and have continued to soar above what we normally expect. We’ve seen an average increase of 50% in daily sales since May.

Due to the global COVID-19 pandemic, the automotive industry is facing new challenges in vehicle sales, fixed operations, customer behavior, and economic outlook. We’ve put together a graphic that lays out the automotive trends created by coronavirus. Consider these insights as you adapt your auto business to the changing landscape.

Stay Up-To-Date on Industry Topics

Fixed Ops trends, tips for growing online profits, and more